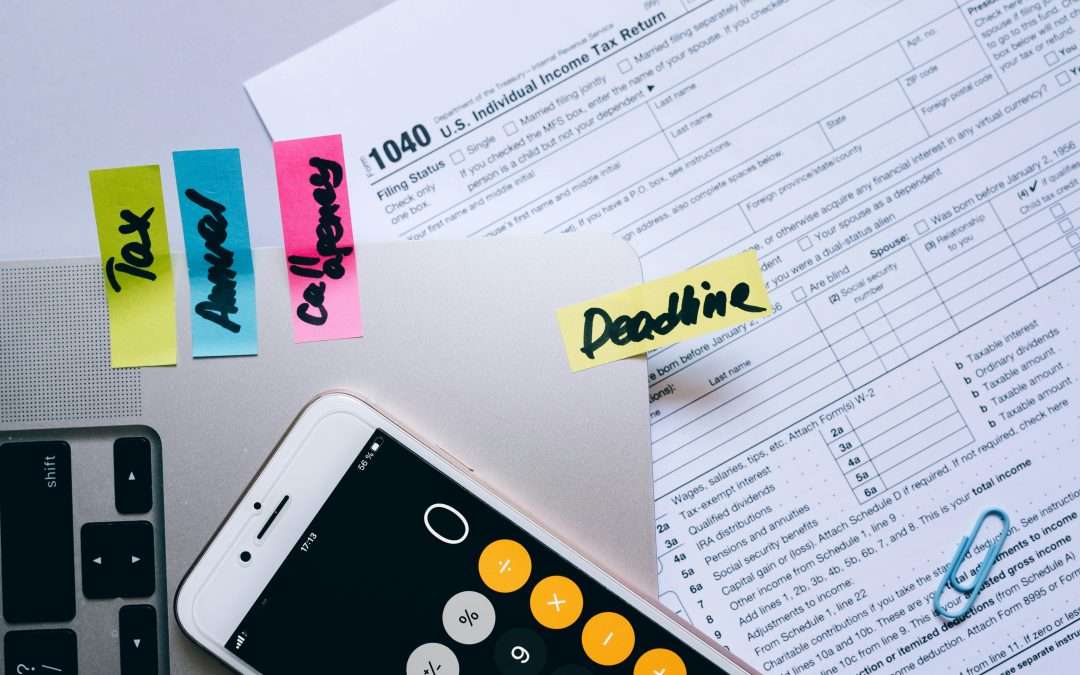

Tax, Accounting & Business Advisory

Free up your time and energy to do more of what you love by taking advantage of our services

4 Locations in the UK

Offices in Stockton, London, Sunderland, and Edinburgh

Tax, Accounting & Business Advisory

Free up your time and energy to do more of what you love by taking advantage of our services

4 Locations in the UK

Offices in Stockton, London, Sunderland, and Edinburgh

Featured Insight

Small Business Matters

Download this financial guide to help launch, grow, and sell your business.

Small Business Matters

Send download link to:

What We Do

Beyond Services: Unleashing Possibilities

VAT Services

Corporation Tax

Payroll

Bookkeeping

Streamlined VAT Management for Compliance and Cost Efficiency

Navigate the complexities of VAT with ease using BJM Group's expert VAT services. We assist with VAT registration, preparation, and submission of returns, ensuring you stay compliant with HMRC requirements. Our team is here to help you manage your VAT obligations efficiently, so you can focus on running your business.

Our VAT services also include strategic advice on managing VAT more effectively within your business operations. We help you identify potential VAT savings and ensure that your VAT processes are optimised for efficiency. With BJM Group, you gain a partner who understands the intricacies of VAT and is committed to helping you minimise costs and maximise compliance.

Expert Tax Planning and Compliance to Optimise Your Business's Financial Position

Stay compliant and optimize your tax position with BJM Group's Corporation Tax services. We provide expert advice on tax planning, preparation, and filing, ensuring you meet all HMRC requirements while minimizing your tax liabilities. Let us handle the complexities of corporate tax so you can focus on growing your business.

In addition to ensuring compliance, our Corporation Tax services include proactive tax planning strategies tailored to your business. We work with you throughout the year to identify opportunities for tax savings and help you navigate changes in tax legislation. Our goal is to optimize your tax position and contribute to your business’s financial success.

Let us take the stress of payroll off your shoulders

Simplify your payroll process with BJM Group's reliable Payroll services. We handle everything from calculating wages and deductions to managing PAYE, NI, and pension contributions. Our service ensures your employees are paid accurately and on time, while keeping you compliant with UK payroll regulations.

Beyond processing payroll, we offer comprehensive support to ensure your payroll system is efficient and compliant. From managing employee benefits to handling complex payroll queries, our service is designed to reduce your administrative burden and ensure a smooth payroll experience for both you and your employees.

Trust your books with us

Keep your financial records accurate and up-to-date with BJM Group's professional Bookkeeping services. We manage your day-to-day transactions, ensuring your books are always in order. Our streamlined approach allows you to focus on running your business while we handle the financial details.

With BJM Group, bookkeeping becomes more than just record-keeping; it’s the foundation of your financial success. Our meticulous attention to detail ensures that your financial data is always accurate, enabling you to make decisions based on reliable information. Trust us to keep your books balanced and your business on solid ground.

News and Updates

HMRC Compliance Check: What It Is and How to Prepare

HMRC conducts compliance checks as an essential component of the UK tax system; these inspections guarantee that individuals and businesses meet their tax obligations. They…

How to Claim the Foreign Earned Income Exclusion: A Guide for U.S. Expats in London

For American expats living in London, understanding how to claim the Foreign Earned Income Exclusion (FEIE) is key to reducing U.S. tax liability. The FEIE…

Hiring an International Tax Specialist: Why It’s Worth It for Americans in the UK

International tax concerns, particularly for Americans living in the United Kingdom, are complex and often unsettling. They cover two tax systems, filing procedures, and various…

How US Expats Can Navigate UK Pensions: Taxes, Savings, and Retirement Planning

The United Kingdom has historically attracted US expats seeking new opportunities, such as professional advancement, academic pursuits, or lifestyle adjustments. With a rich history and…

Understanding Self Employment Income Tax for Americans Living in the UK

For US citizens or green card holders residing in the UK and working as self-employed, tax obligations become even more challenging because the US has…

US Tax Filing Deadlines for Expats in London: Avoid These Common Mistakes

Keeping up with US tax filing deadlines can be especially challenging for American expats in London, who must juggle cultural adaptation and career growth with…

How the UK–US Double Tax Treaty Helps American Expats in London Save on Taxes

The UK-US Double Tax Treaty promotes economic cooperation by prohibiting double taxation on the same income for individuals and enterprises in both countries. It establishes…

FATCA vs FBAR Explained: Essential Compliance for US Expats Living in London

Living abroad in a global metropolis like London can be exciting and full of opportunity, but for American expats, it also comes with unique financial…

Filing US Taxes from UK: A Complete Guide for American Expats in London

Filing US taxes from UK presents a unique and often overwhelming challenge for American residents living abroad. Due to the United States’ citizenship-based taxation system,…

Understanding UK Tax Deadlines and Penalties

Tax compliance is essential for people as well as companies running in the UK. Missed deadlines could result in fines, interest costs, and maybe legal…